Accounting is the process of recording, summarizing, and analyzing financial transactions. It helps businesses keep track of their money. Whether it’s buying or selling products, paying employees, or tracking income, accounting is crucial. In simple terms, accounting is the language of business. It tells you how much money a company has, how much it owes, and how well it’s performing.

The Basics of Accounting

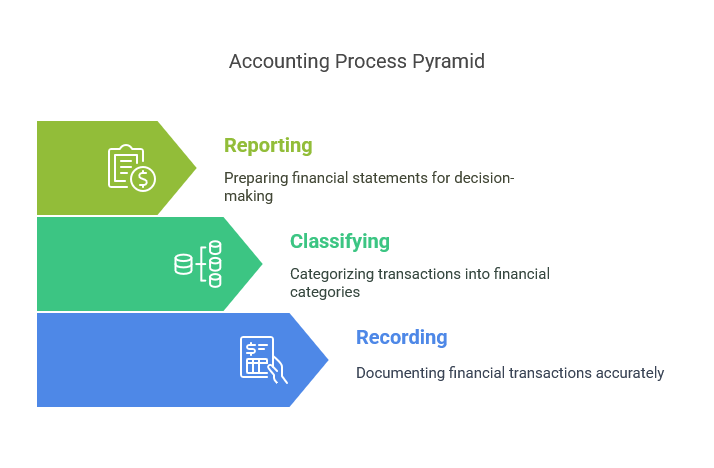

At its core, accounting revolves around three major principles: recording transactions, classifying them, and reporting them. Accountants follow these steps to ensure businesses stay financially healthy. They use standard systems like the double-entry bookkeeping system. This helps keep financial records accurate.

-

Recording Transactions: Every time money changes hands, accountants record it. This is done through invoices, receipts, and payment records. For example, when a business sells a product, an accountant records the sale.

-

Classifying Transactions: Once transactions are recorded, they are classified. These categories include assets, liabilities, income, and expenses. This classification helps businesses understand where their money is coming from and where it’s going.

-

Reporting Transactions: After transactions are classified, accountants prepare financial statements like the balance sheet, income statement, and cash flow statement. These reports help business owners and managers make decisions about their business.

Why is Accounting Important?

Accounting is essential for every business, large or small. Without accounting, business owners would have no way of knowing how much money they’re making or spending. Here’s why accounting matters:

-

Helps Make Informed Decisions: With clear financial information, businesses can make better decisions. For example, if a business is losing money, the owner might decide to cut unnecessary costs or change pricing strategies.

-

Ensures Compliance: Businesses must follow laws and regulations, especially regarding taxes. Accounting helps ensure that companies comply with tax laws by keeping accurate records.

-

Attracts Investors: Investors rely on financial statements to assess the health of a business. If a company has strong accounting practices, it is more likely to attract investment.

-

Tracks Profitability: Accounting tracks how much money a business is making versus how much it is spending. This helps identify profitable areas and areas that need improvement.

Types of Accounting

There are several types of accounting, each serving a specific purpose. Here are the main types:

-

Financial Accounting: This type of accounting focuses on creating financial statements for external users like investors, banks, and government agencies.

-

Managerial Accounting: This type provides information for internal decision-making. It helps business owners plan for the future by tracking budgets, costs, and profits.

-

Tax Accounting: Tax accounting is focused on preparing tax returns and ensuring that businesses comply with tax laws.

-

Forensic Accounting: This type investigates financial fraud and discrepancies. Forensic accountants often work with law enforcement agencies to investigate criminal activities like embezzlement.

The Accounting Process: Step-by-Step

Accounting is a step-by-step process that involves gathering, organizing, and reporting financial data. Here’s how the process works:

-

Transaction Occurs: A business transaction happens, like a sale or purchase.

-

Journal Entry: The transaction is recorded as a journal entry in the accounting system.

-

Post to Ledger: The journal entry is transferred to the general ledger, where all financial data is summarized.

-

Trial Balance: The trial balance is prepared to ensure that the accounts are balanced.

-

Prepare Financial Statements: Once everything is balanced, accountants prepare financial statements, such as the balance sheet and income statement.

-

Close the Books: At the end of the period, accountants close the books and start the process again for the next period.

Common Accounting Terms You Should Know

Here are some common accounting terms that can help you better understand accounting:

-

Assets: Things a business owns, like cash, equipment, and buildings.

-

Liabilities: Money a business owes, such as loans or accounts payable.

-

Equity: The owner’s claim on the business’s assets, also known as “owner’s equity.”

-

Revenue: Income from sales or services provided by the business.

-

Expenses: The costs associated with running a business, such as rent, salaries, and utilities.

-

Net Income: The profit or loss a business makes after subtracting expenses from revenue.

Accounting vs. Bookkeeping: What’s the Difference?

While accounting and bookkeeping are related, they are not the same. Bookkeeping is the process of recording transactions. It’s more focused on the day-to-day aspects of finance, like managing receipts and invoices. Accounting, on the other hand, involves summarizing, analyzing, and reporting the financial data recorded by bookkeeping.

-

Bookkeeping: Recording financial transactions.

-

Accounting: Analyzing, interpreting, and reporting financial information.

Who Needs Accounting?

Everyone who handles money needs accounting. Here’s who can benefit from accounting:

-

Businesses: Every business, big or small, needs accounting to track its finances, make decisions, and remain compliant with tax laws.

-

Individuals: Personal accounting helps individuals manage their finances, such as budgeting, saving, and investing.

-

Nonprofits: Nonprofit organizations use accounting to ensure their funds are being spent in line with their mission and are accounted for properly.

Accounting Software: A Modern Solution

In today’s digital age, many businesses use accounting software to automate and streamline the accounting process. Some popular accounting software includes:

-

QuickBooks: One of the most popular accounting software programs for small businesses.

-

Xero: A cloud-based accounting software used by businesses of all sizes.Official Website

-

FreshBooks: Accounting software focused on invoicing and billing for freelancers and small businesses.

These tools help businesses keep track of financial transactions, prepare reports, and ensure compliance with tax laws.

Accounting Careers: Opportunities and Growth

Accounting is a growing field with plenty of career opportunities. Here are some popular accounting jobs:

-

Certified Public Accountant (CPA): CPAs are licensed accountants who provide services like tax preparation, auditing, and financial consulting.

-

Management Accountant: Management accountants work within a company, helping with budgeting and financial planning.

-

Financial Analyst: Financial analysts analyze financial data to help companies make investment decisions.

-

Forensic Accountant: Forensic accountants investigate fraud and financial crimes.

According to the U.S. Bureau of Labor Statistics, accounting jobs are expected to grow by 6% from 2020 to 2030, which is faster than average. This growth is driven by the increasing complexity of financial regulations and the need for businesses to manage their finances efficiently.

Common Mistakes in Accounting and How to Avoid Them

-

Not Keeping Accurate Records: Failing to keep detailed records can lead to missed deductions and tax problems.

-

Mixing Personal and Business Finances: It’s essential to keep personal and business finances separate.

-

Neglecting to Reconcile Accounts: Regularly reconciling accounts helps identify discrepancies early.

-

Forgetting to Budget: A budget helps track spending and ensures that expenses are in line with revenue.

FAQ: What is Accounting?

1. What are the different types of accounting?

There are four main types: financial accounting, managerial accounting, tax accounting, and forensic accounting.

2. Why is accounting important for a business?

Accounting helps track money, make decisions, ensure compliance, and attract investors.

3. How does accounting help manage taxes?

Accounting helps businesses track income and expenses, ensuring that they pay the right amount of tax.

4. What is the difference between accounting and bookkeeping?

Bookkeeping focuses on recording transactions, while accounting involves analyzing and reporting financial information.

5. How can I learn accounting?

You can learn accounting through online courses, formal education, or by using accounting software.

Accounting is a vital skill for managing money, whether for personal or business purposes. By recording, classifying, and reporting financial transactions, accounting helps businesses make informed decisions and stay compliant with the law. If you’re new to accounting, starting with the basics is a great way to build your understanding.