Managing your money effectively is one of the most critical skills you can develop in life. In today’s world, where financial instability can arise quickly, having control over your finances ensures that you can live comfortably and avoid the stress that often comes with poor economic management. If you’re wondering why it is essential to manage your money, this article will explore the numerous benefits and reasons why you should prioritise managing your finances. From achieving financial stability to securing your future, let’s explore how effective financial management can significantly enhance your life.

What is Money Management?

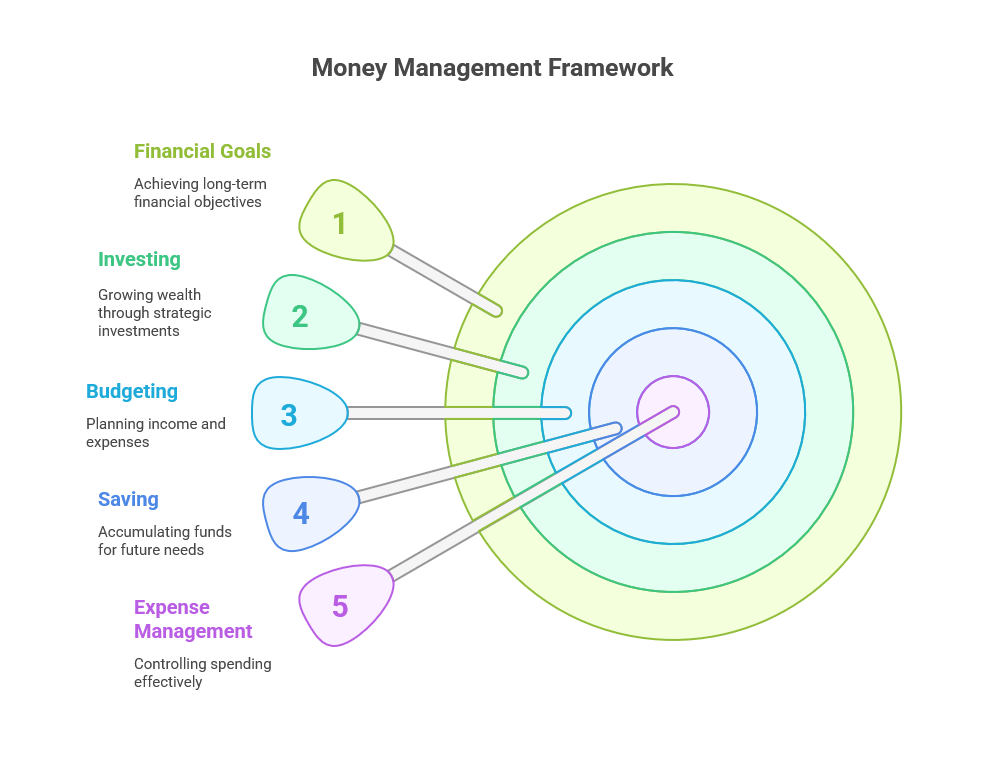

Money management is the process of organising, controlling, and planning your finances. It involves budgeting, saving, investing, and managing expenses to ensure you can meet your financial goals. It’s about knowing where your money is going, how much you’re earning, and how to use it wisely. Money management extends beyond simply saving money; it also means making your money work for you, allowing you to build wealth and avoid financial stress.

Why is it Important to Manage Your Money?

Money management is essential for several reasons. It helps you avoid debt, saves you money, and ensures you are financially prepared for the future. Below are some of the key reasons why managing your money is essential:

1. Achieve Financial Stability

Managing your money effectively allows you to avoid living paycheck to paycheck. When you manage your finances effectively, you can pay bills on time, prevent debt accumulation, and start saving. Financial stability reduces the risk of incurring debt and enables you to live a life free from constant financial worries. A stable financial foundation gives you the confidence to face unforeseen challenges.

Having a well-organised financial plan helps you navigate unexpected costs. Whether it’s a medical emergency, car repair, or job loss, a stable economic plan ensures you’re not caught off guard. You can navigate life’s ups and downs with greater peace of mind and reduced stress.

2. Save for the Future

One of the most critical aspects of managing your money is saving for the future. Life is unpredictable, and having savings can provide a safety net in times of need. Whether you’re saving for retirement, an emergency fund, or a down payment on a house, setting aside a portion of your income each month is key to achieving long-term financial security.

The earlier you start saving, the more time your money has to grow and accumulate interest. Even small, regular contributions can add up over time due to the power of compound interest. It’s not just about saving; it’s about creating a financial cushion that will allow you to live comfortably later in life.

3. Protect Yourself from Debt

Debt is one of the biggest threats to financial security. Credit cards, loans, and high-interest debt can quickly spiral out of control if not managed properly. Effective money management allows you to track your spending, set a budget, and avoid overspending. By prioritising your debt payments and limiting unnecessary expenses, you can reduce your financial burdens.

When you manage your money, you can avoid credit card debt, payday loans, and other high-interest loans that often trap people in a cycle of debt. Managing your finances proactively ensures that you can pay off your debts before they become overwhelming.

4. Achieve Financial Independence

Financial independence means having enough savings and investments to support yourself without relying on others. Whether it’s your family, friends, or the government, financial independence gives you the freedom to make choices that align with your goals and values. You don’t have to rely on a paycheck to sustain your lifestyle, and you can focus on doing things that bring you joy.

Managing your money is the key to achieving financial independence. By saving and investing wisely, you can generate passive income streams that will support your lifestyle without the need for a 9-to-5 job. The earlier you start managing your money, the sooner you can achieve the freedom that financial independence brings.

5. Reduce Financial Stress

Money problems are one of the leading causes of stress in people’s lives. If you live paycheck to paycheck or struggle to pay bills, it can affect your mental and physical health. Managing your money effectively can help alleviate this stress and enhance your overall quality of life.

When you know that you have enough money saved for emergencies and future goals, you can focus on enjoying your life rather than worrying about money. Being financially prepared helps you feel more in control and less anxious about unforeseen expenses or financial setbacks.

6. Build Wealth Over Time

Effective money management can help you grow your wealth. By investing in the right opportunities, such as stocks, real estate, or bonds, you can build a portfolio that generates returns over time. The more you manage your money wisely, the more opportunities you’ll have to accumulate wealth.

Investing allows your money to work for you. The earlier you start investing, the more time your investments have to grow, thanks to the magic of compound interest. A sound investment strategy ensures that you can retire comfortably and leave a financial legacy for future generations.

7. Improve Your Credit Score

A good credit score is crucial for securing loans, mortgages, and even specific job opportunities. Poor credit management can result in a low credit score, leading to higher interest rates and increased borrowing costs. Managing your money helps you pay bills on time, reduce debt, and improve your credit score.

A higher credit score opens up better financial opportunities. For instance, with a good credit score, you can qualify for lower interest rates on mortgages, car loans, and credit cards, which can save you money in the long run.

8. Make Informed Financial Decisions

Effective money management helps you make informed decisions about your finances. When you track your spending, income, and savings, you can evaluate whether you’re on track to reach your financial goals. Money management tools, such as budgeting apps or spreadsheets, provide a clear picture of your financial situation, enabling you to make informed decisions about how to allocate your money.

Being informed about your finances enables you to make smarter decisions about spending, investing, and saving. You can adjust your spending habits to ensure you meet your financial objectives.

The Risks of Not Managing Your Money

Failing to manage your money can lead to numerous financial issues. The most common risks include:

1. Increased Debt

Without proper financial management, debt can quickly accumulate. Whether it’s credit card debt, student loans, or medical bills, the lack of control over spending can lead to financial problems. The longer you ignore debt, the more it grows due to interest, making it harder to pay off in the future.

2. Missed Financial Opportunities

If you don’t manage your money effectively, you might miss opportunities to save, invest, or grow your wealth. Many people fail to take advantage of the benefits of investing in the stock market or buying property simply because they lack the financial awareness or discipline to do so.

3. Financial Instability

Without money management, your financial situation can quickly spiral into instability. Not having a savings buffer or emergency fund can leave you vulnerable to unexpected expenses. In times of crisis, such as illness or job loss, you may struggle to make ends meet, which can cause stress and anxiety.

How to Start Managing Your Money

Managing your money might sound overwhelming, but it doesn’t have to be. Here are some simple steps you can take to get started:

1. Create a Budget

The first step in managing your finances is to create a budget. A budget helps you track your income and expenses and ensures you’re not overspending. Start by listing all your monthly income and expenses, and identify areas where you can cut back. By sticking to a budget, you can live within your means and save for future goals.

2. Start Saving

Start by setting aside a portion of your income for savings. Aim to save at least 10-20% of your income each month. If possible, set up automatic transfers to your savings account to prevent forgetting. A savings plan ensures you’re building a financial cushion for the future.

3. Invest Wisely

Once you’ve built a savings foundation, it’s time to invest. Research various investment options, such as stocks, bonds, and real estate, and select investments that align with your financial objectives and risk tolerance. Regularly investing helps you build wealth over time.

4. Pay Off Debt

Debt can be a significant obstacle to financial freedom. Focus on paying off high-interest debts first, such as credit card debt. Once you’ve cleared your high-interest debts, work on paying off other loans. The less debt you have, the more you can save and invest.

FAQs

1. Why is it important to manage your money?

Managing your money ensures financial stability, helps you avoid debt, and allows you to save for the future. It reduces financial stress and gives you the freedom to make economic choices.

2. How do I manage my money effectively?

To manage your money effectively, create a budget, save regularly, invest wisely, and avoid unnecessary debt. Stay informed about your finances to make informed decisions.

3. What are the consequences of not managing your money?

Failing to manage your money can lead to increased debt, missed opportunities to grow wealth, and financial instability. Poor money management can cause stress and anxiety.

4. How can I improve my credit score?

Pay bills on time, reduce debt, and avoid accumulating new debt. Managing your money effectively can improve your credit score, which opens up better financial opportunities.

5. How much should I save each month?

Aim to save at least 10-20% of your monthly income. Consistent saving, even in small amounts, can lead to significant savings over time.

Managing your finances is crucial for a stable and secure financial future. Whether you’re saving for emergencies, building wealth, or achieving financial independence, good money management is the key to success. Start today by creating a budget, saving regularly, and investing wisely. By doing so, you’ll improve your financial well-being and set yourself up for a better future.