The crypto exchange business has quickly become one of the most lucrative sectors in the world of finance. With the rise of digital currencies like Bitcoin, Ethereum, and newer altcoins, starting a crypto exchange business in 2025 might be your ticket to financial success. In this blog post, we’ll explore what a crypto exchange is, how you can start one, and why now is the right time to jump in.

According to a report by CoinTelegraph, the global crypto market has grown by over 200% in the past three years, with new exchanges being launched daily. The report also indicates that more institutional investors are entering the crypto space, which could further drive demand for exchanges in the

What Is a Crypto Exchange Business?

A cryptocurrency exchange is an online platform that enables users to buy, sell, and trade digital currencies. It serves as a marketplace where individuals and institutions can exchange cryptocurrencies for other digital assets or fiat currencies, such as the US dollar (USD) or the euro (EUR). There are two types of exchanges: centralized and decentralized. A single company runs centralized exchanges, while decentralized exchanges operate without a central authority.

The global market for cryptocurrency exchanges is expected to continue growing at a rapid pace. According to CoinMarketCap, the total market capitalization of cryptocurrencies has surpassed $2 trillion in recent years, and it is expected to continue growing.

Why Should You Start a Crypto Exchange Business?

-

Massive Market Potential

The crypto industry has seen rapid growth in recent years. As more people become aware of the benefits of digital currencies, an increasing number of users are flocking to exchanges to trade and invest. Starting a cryptocurrency exchange provides access to a growing market of investors and traders. -

Diversified Revenue Streams

Crypto exchanges can generate income in several ways:-

Transaction Fees: Every trade on your platform can earn you a small fee. With millions of transactions daily, this can be very profitable.

-

Listing Fees: You can charge cryptocurrency projects to list their tokens on your exchange.

-

Withdrawal and Deposit Fees: Some exchanges charge fees for deposits and withdrawals in fiat or crypto.

-

-

Reputation and Trust in the Market

As the world shifts towards digital assets, exchanges have become essential for people to enter the crypto world. If you run a secure and reliable platform, you can build a trustworthy reputation and attract users from all around the globe.

Steps to Start a Crypto Exchange Business

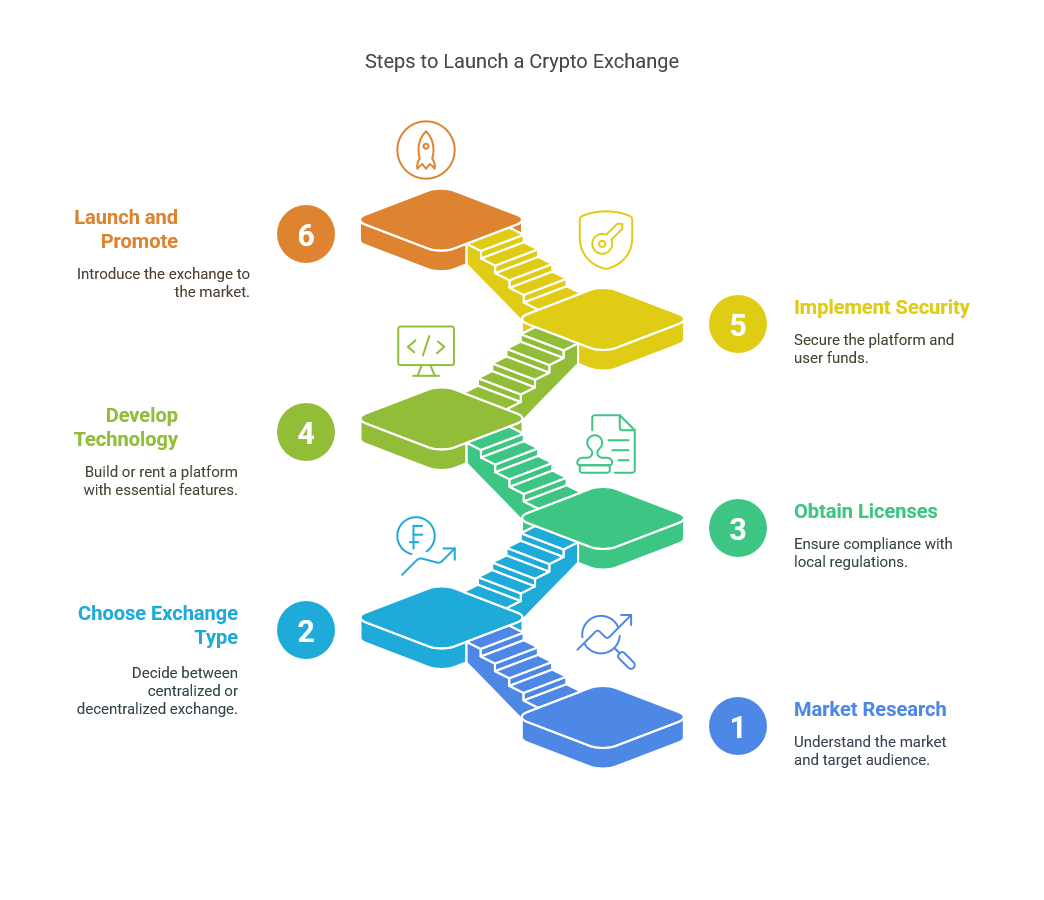

1. Research the Market

Before launching your crypto exchange, you must understand the market. Research competitors and identify gaps in their services. You must also understand your target audience. Are you focusing on individual traders, institutional investors, or both? The type of audience you choose will affect how you build and market your exchange.

2. Choose the Type of Exchange

-

Centralized Exchange: A centralized exchange (CEX) is the most common model. Users’ funds are held by the exchange, making it easier to facilitate transactions. However, it also makes the exchange more vulnerable to hacking and security risks.

-

Decentralized Exchange: A decentralized exchange (DEX) doesn’t store users’ funds. Instead, it matches buyers and sellers on the blockchain. DEXs are less vulnerable to hacking, but they also have lower liquidity and slower transactions.

You need to determine which type of exchange best suits your business model and target market.

3. Get the Necessary Licenses

In many countries, operating a crypto exchange requires a license. The regulatory environment is still developing, and it differs by country. Some countries, such as Japan and Switzerland, have favorable regulations for cryptocurrency businesses, while others are more restrictive.

Ensure you consult with a legal professional to ensure compliance with local laws.

4. Choose a Platform and Develop the Technology

You have two options for building the technology behind your exchange:

-

Build from Scratch: You can hire a development team to create a custom crypto exchange platform tailored to your business needs.

-

Utilize a White-Label Solution: A white-label solution allows you to rent pre-built exchange software and customize it to meet your specific needs. This is faster and more affordable than building from scratch.

Ensure the platform offers features such as high liquidity, a user-friendly interface, robust security, and scalability.

5. Set Up Security Measures

Security is one of the most crucial aspects of operating a cryptocurrency exchange. You need to ensure that both your platform and your users’ funds are safe. Here are some key security measures to consider:

-

Two-Factor Authentication (2FA): This adds an extra layer of security to user accounts by requiring a second form of verification during login.

-

Cold Wallet Storage: Keep the majority of your users’ funds in cold wallets, which are not connected to the internet, to protect them from hacking.

-

Anti-money Laundering (AML) and Know Your Customer (KYC): Implement AML and KYC policies to prevent fraud and comply with regulations.

6. Launch and Promote

Once your platform is ready, it’s time to launch. Start by promoting your exchange on social media, cryptocurrency forums, and relevant blogs. You can also offer incentives, such as reduced fees or free listings for the first few months, to attract early users.

Focus on building a strong community around your exchange. Offer customer support, engage with users, and provide educational resources about crypto trading to help people get started.

Key Challenges in the Crypto Exchange Business

While the crypto exchange business can be profitable, it does come with challenges:

-

Security Risks: As mentioned earlier, crypto exchanges are prime targets for hackers. You need to invest in top-notch security protocols to protect users’ funds and your platform.

-

Regulatory Challenges: The regulatory landscape is constantly evolving and varies from one jurisdiction to another. Ensure your business complies with all applicable rules to avoid fines or shutdowns.

-

High Competition: The cryptocurrency exchange market is highly competitive, with several established players, including Binance, Coinbase, and Kraken. You’ll need to find ways to differentiate your exchange from the competition.

-

Market Volatility: Cryptocurrencies are known for their volatility. The value of coins can fluctuate dramatically, which can impact your exchange’s revenue from transaction fees.

Key Features Your Crypto Exchange Should Have

When launching a cryptocurrency exchange, prioritize features that will ensure your platform stands out in the market.

1. User-Friendly Interface

Ensure your platform is intuitive and easy to use, even for those with no prior experience. Simple navigation and intuitive design are essential for attracting new users.

2. Multiple Cryptocurrencies

Offer support for multiple cryptocurrencies, including popular options such as Bitcoin, Ethereum, and Litecoin. You can also consider adding lesser-known altcoins to attract niche investors.

3. Mobile App

In 2025, mobile trading is crucial. Consider developing a mobile app that allows users to trade on the go.

4. Advanced Trading Tools

Provide advanced charting tools, margin trading, and stop-loss orders for professional traders. These features will make your exchange more appealing to experienced traders.

5. Liquidity

Liquidity is vital for the success of any exchange. You will need to ensure there is sufficient liquidity for users to trade easily.

FAQs About Crypto Exchange Business

1. What is a crypto exchange business?

A cryptocurrency exchange is a platform where users can buy, sell, and trade digital currencies. It can be centralized or decentralized, depending on how it is managed.

2. How do crypto exchanges make money?

Crypto exchanges generate revenue through transaction fees, listing fees, and fees for withdrawals and deposits. They may also charge fees for premium features or services.

3. Do I need a license to operate a crypto exchange?

Yes, operating a crypto exchange requires a license in many jurisdictions. Regulations vary by country; therefore, it is advisable to consult a legal expert to ensure compliance.

4. What security measures should a crypto exchange have?

A crypto exchange should have robust security features, including two-factor authentication (2FA), cold wallet storage, and anti-money laundering (AML) and know-your-customer (KYC) procedures.

5. How can I promote my crypto exchange?

You can promote your crypto exchange through social media, cryptocurrency forums, and partnerships with other crypto businesses. Offering incentives to early users can also help attract customers.