Financial loss can happen at any time. Whether it’s from accidents, health problems, or damage to your property, unexpected costs can strain your finances. But there’s a way to protect yourself and your loved ones—insurance. By investing in the right policies, you can shield yourself from the financial impact of these events.

In this blog, we’ll explore how insurance works, the types of insurance available, and how it helps prevent financial loss. Whether you’re new to insurance or want to understand it better, this article will explain everything in simple terms.

What Is Insurance?

Insurance is a contract where you pay a regular amount, called a premium, to a company. In return, the company promises to cover some or all of your financial losses in case of an unexpected event. This protection helps you avoid the economic burden of events that could otherwise be devastating.

For example, imagine your car gets into an accident. Without insurance, you may have to pay for repairs out of pocket, which could be costly. But with insurance, the company will help cover the cost, reducing your financial stress.

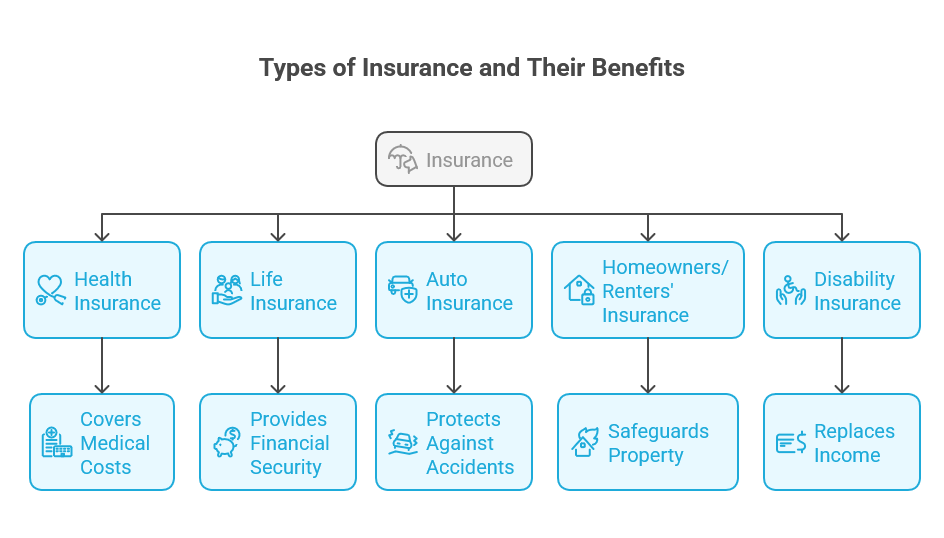

Types of Insurance That Protect You from Financial Loss

Insurance comes in many forms. Each type protects you against different risks. Here are the most common types:

1. Health Insurance

Health insurance helps cover medical costs. Whether you’re sick or injured, it ensures you won’t face huge medical bills. It may cover doctor visits, hospital stays, surgeries, and medications. Without health insurance, a simple illness can lead to financial ruin.

2. Life Insurance

Life insurance ensures your family is financially secure if something happens to you. If you pass away, your beneficiaries (usually your family) will receive a payout. This helps them cover mortgage payments, school fees, and daily living costs. It provides peace of mind, knowing your loved ones will not struggle financially after your passing.

3. Auto Insurance

Auto insurance protects your car and yourself in case of an accident. It can cover repairing your vehicle, medical expenses, and damage caused to others. Driving without insurance could result in costly fines, repair bills, and legal fees. Insurance ensures that an accident doesn’t lead to financial hardship.

4. Homeowners or Renters’ Insurance

Homeowners’ insurance protects your property against damage from fire, theft, or natural disasters. It also covers liability if someone is injured in your home. Renters’ insurance provides similar protection for those without a home but still want to safeguard their belongings. Insurance can prevent financial loss if your home is damaged or someone gets hurt on your property.

5. Disability Insurance

If you can’t work due to illness or injury, disability insurance provides income replacement. It ensures you can continue paying bills and supporting your family, even if you cannot earn a paycheck. This type of insurance is often overlooked but is crucial for long-term financial stability.

Why Do You Need Insurance?

Life is full of uncertainties. No matter how careful you are, accidents, natural disasters, and health problems can strike anytime. Without insurance, you’d be left to cover the costs of these unexpected events on your own. That can drain your savings, put you into debt, or even cause financial ruin.

With the right insurance policies, you can:

-

Protect your health, home, and car from high repair or medical bills.

-

Ensure your family is taken care of if something happens to you.

-

Keep your financial stability even in tough times.

Insurance helps reduce the financial impact of the unexpected, giving you a safety net when you need it most.

The Financial Benefits of Insurance

1. Reduces Financial Burden

When you face unexpected costs, insurance can ease the financial burden. Insurance covers the expenses, whether it’s a medical emergency, an accident, or home damage. This prevents you from depleting your savings or taking out loans.

2. Provides Peace of Mind

Having insurance brings peace of mind. Knowing you have a safety net allows you to focus on other things, like enjoying life or planning for the future. You won’t have to worry about how to pay for an emergency.

3. Helps You Build Wealth Over Time

Some types of insurance, such as life insurance with a savings component, can help you build wealth. By setting aside money in a policy, you can grow your savings and use them in the future. It’s a way to protect your finances while planning for the long term.

How Insurance Saves You From Major Financial Loss

Example 1: Health Insurance

Consider a person who doesn’t have health insurance. They suddenly fall ill and require surgery. The cost of the surgery and hospital stay may run into thousands of dollars. Without insurance, they’ll need to cover these costs entirely, which could lead to significant debt.

With health insurance, most of the costs would be covered. The person would only need to pay a small portion, like a deductible or copayment, which saves them from the financial strain of paying the full amount.

Example 2: Homeowners’ Insurance

A family’s home gets damaged in a fire. Without insurance, they would have to pay for repairs out of pocket, which could cost tens of thousands of dollars. However, with homeowners’ insurance, the insurance company helps cover the repair costs, allowing the family to rebuild their lives without going bankrupt.

Is Insurance Always the Best Option?

While insurance provides protection, assessing your needs is essential before choosing a policy. Not every type of insurance is necessary for everyone. For example, auto insurance may be unnecessary if you don’t own a car. Homeowners’ insurance may not be essential if you live in a rented apartment.

Evaluate your situation carefully. Determine the risks you face and how much coverage you need. You don’t want to overpay for insurance you don’t need, but at the same time, you shouldn’t leave yourself unprotected.

How to Choose the Right Insurance for You

1. Evaluate Your Risks

What are the most common risks you face? Do you have a car? Do you own a home? Are you planning a family? Identifying the risks will help you determine the types of insurance you need.

2. Compare Insurance Providers

Don’t settle for the first insurance company you come across. Compare policies, premiums, and coverage options. Look for an insurance provider that offers the best value for your needs.

3. Understand the Terms

Before signing any policy, read the terms carefully. Understand what’s covered and what’s not. Make sure there are no hidden fees or exclusions that could leave you unprotected.

Common Insurance Myths

1. “I Don’t Need Insurance Because I’m Healthy.”

This is a common myth, especially when it comes to health insurance. Health problems can arise anytime, even if you’re healthy now. Medical bills can be costly, and having insurance ensures you’re covered.

2. “I’m Too Young for Life Insurance.”

Many people think they only need life insurance when they’re older or have dependents. But the younger you are, the cheaper life insurance can be. It’s better to start early and lock in a low premium.

3. “Insurance Is Too Expensive.”

While premiums can vary, insurance is often more affordable than paying for an emergency out of pocket. Consider the financial protection it provides before deciding that it’s too expensive.

FAQs About Insurance

1. What is the best type of insurance to have?

It depends on your needs. The most common types are health, auto, and life insurance. Evaluate your risks and choose the coverage that suits your situation.

2. How much insurance do I need?

This varies based on your financial situation and the risks you face. Ensure you have enough coverage to protect your home, health, and income.

3. Is insurance worth the cost?

Insurance is worth it for the protection it provides. While premiums may seem like an added expense, they’re far cheaper than paying for an emergency out of pocket.

4. Can insurance cover everything?

No, insurance doesn’t cover everything. Make sure to read the terms of your policy to understand the exclusions and limitations.

5. How do I know if I need insurance?

If you face health issues, accidents, or property damage, consider insurance. Evaluate your risks and get coverage that fits your life.

Insurance is a crucial tool for protecting yourself from financial loss. It ensures that unexpected events don’t ruin your financial stability. Whether it’s health problems, accidents, or property damage, having the right insurance policy can save you from major financial setbacks. Take the time to evaluate your needs, compare providers, and choose the best insurance. Don’t wait for an emergency—prepare today and secure your future with insurance.