In today’s fast-paced world, managing personal finances effectively is more critical than ever. Between monthly bills, unexpected expenses, and long-term savings goals, it’s easy to feel overwhelmed by your financial situation. Fortunately, tools like Know Your Dosh have been developed to help individuals take control of their money in a more straightforward and organised way. But does Know Your Dosh live up to its promises? In this detailed review, we’ll explore the features, pros, cons, and how this tool can help you manage your finances better.

What is Know Your Dosh?

Know Your Dosh is an easy-to-use personal finance tool designed for people who want to take control of their spending, track their income, and create adequate budgets. The tool streamlines financial management by providing users with an intuitive interface that helps them visualise their spending, set financial goals, and work towards achieving them. It’s particularly suitable for individuals who need a straightforward, user-friendly tool that provides clear insights into their economic behaviour.

👍 Get Stunning Lifetime Access Now!

Key Features of Know Your Dosh

One of the standout features of Know Your Dosh is its simplicity. Unlike many finance tools that require users to dive into complex charts and reports, Know Your Dosh focuses on presenting your financial data in an easy-to-understand format. Let’s look at some of its key features in more detail:

1. Expense Tracking

The core feature of Know Your Dosh is its expense tracking system. By inputting your daily purchases, the app categorises each expense so you can easily see where your money is going. This allows you to understand your spending habits, identify unnecessary costs, and make informed decisions on where to cut back.

For example, you might discover that you’re spending too much on takeout or unnecessary subscriptions. With this knowledge, you can adjust your spending habits accordingly, helping you save more.

2. Budgeting

Setting a budget is one of the most powerful ways to take control of your finances, and Know Your Dosh makes it incredibly easy. The app allows you to set up customised budgets based on your monthly income and spending categories. You can set specific limits for various spending categories, including groceries, entertainment, and transportation. Know Your Dosh will then send you notifications and reminders to ensure you stay within those limits.

For example, if you’ve set a budget of $200 for groceries, the app will alert you once you’re nearing that limit. This feature helps prevent overspending and encourages better financial discipline.

3. Financial Goals

Know Your Dosh allows you to set financial goals, whether it’s saving for a vacation, an emergency fund, or a new car. The app helps you track your progress and provides insights into how much you need to save each month to meet your target. This makes it easier to visualise your financial objectives and stay motivated as you work toward them.

Imagine you want to save $5,000 for a vacation in the next 12 months. The app will calculate that you need to save around $417 each month to meet your goal. This makes it easy to plan and stay on track.

4. Reports and Analytics

Understanding where your money is going is crucial for making informed decisions. Know Your Dosh provides detailed reports and analytics that offer a comprehensive view of your spending habits. You can access monthly summaries, track your income and expenses, and view spending trends over time.

These reports can help you identify patterns in your financial behaviour. For instance, you may notice that you tend to overspend in certain categories during specific months, such as holidays or special events. With this data, you can plan more effectively for the future.

5. User-Friendly Interface

Unlike many finance apps that can be overwhelming for new users, Know Your Dosh is designed to be intuitive and straightforward. The app’s interface is clean and easy to navigate, making it accessible for everyone, regardless of their level of financial expertise. It doesn’t require a lot of time to set up or learn how to use.

Whether you’re new to personal finance or have been managing your money for years, the user-friendly design of Know Your Dosh ensures you can start using the app with ease and confidence.

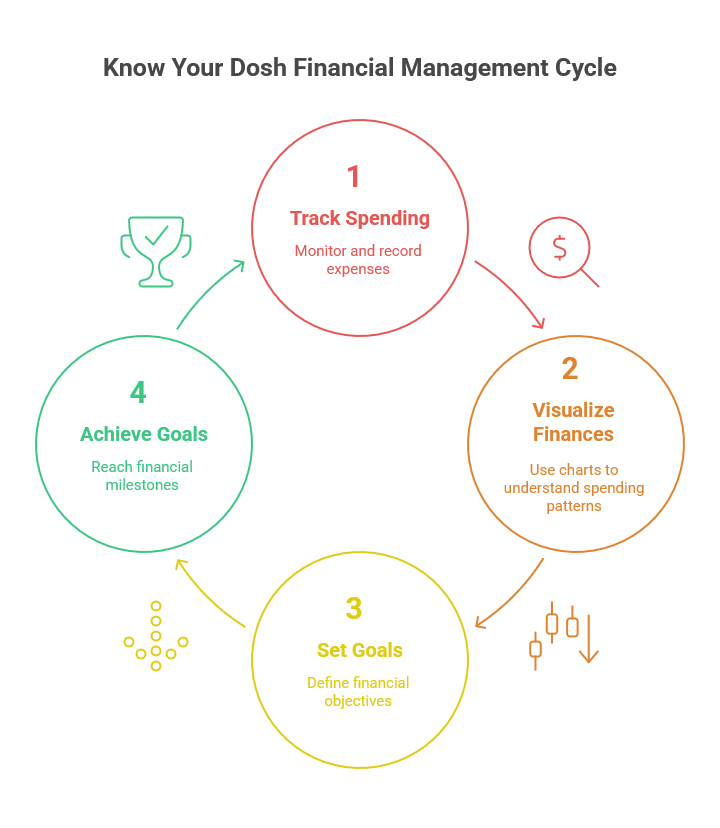

How Does ‘Know Your Dosh’ Help with Financial Management?

Managing your finances can often feel like a complicated task, but Know Your Dosh makes it easier by breaking down your financial situation into manageable pieces. Whether you want to create a budget, track your spending, or save for a specific goal, this tool can help you get a clearer picture of your financial health.

For instance, if you have multiple bills and expenses to keep track of each month, Know Your Dosh helps you organise them by category. This way, you can see exactly how much money you are spending on things like utilities, entertainment, and food. By tracking these expenses, you can identify areas where you might be able to cut back and save more.

Moreover, the ability to set goals within the app is invaluable. If you want to save for a specific goal, such as an emergency fund or a vacation, the app can calculate how much you need to save each month to reach your target. It provides reminders and keeps you motivated, ensuring you stay focused on your financial objectives.

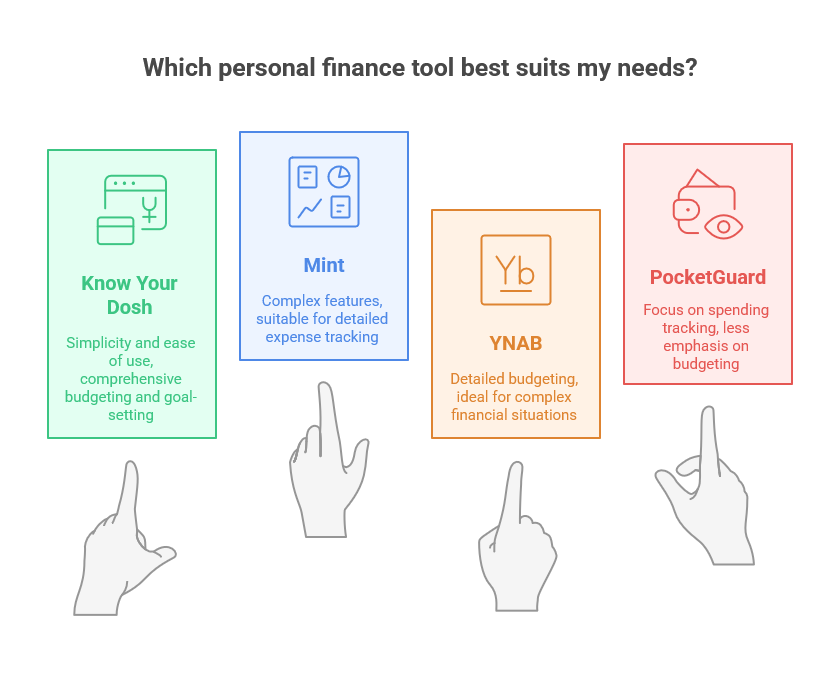

Know Your Dosh vs. Other Personal Finance Tools

With numerous personal finance tools available, how does Know Your Dosh compare to the competition? Let’s take a look at how it compares to some other popular options.

Mint

Mint is one of the most well-known personal finance apps, offering many features similar to Know Your Dosh, including expense tracking, budgeting, and goal-setting. However, Mint is often considered more complex and may be overwhelming for users who prefer a simpler tool. On the other hand, Know Your Dosh focuses on simplicity and ease of use, making it an excellent choice for those seeking an uncomplicated financial tool.

YNAB (You Need a Budget)

YNAB is another excellent budgeting tool, but it requires more time to set up and understand. Its approach to budgeting is more detailed, which can be beneficial for users with complex financial situations. However, for those looking for a quick and easy-to-use tool, Know Your Dosh might be a better option.

PocketGuard

While PocketGuard is designed to help users track their spending, it focuses less on budgeting and goal-setting. Know Your Dosh, however, excels in both areas, making it a more comprehensive tool for users who want a well-rounded approach to financial management.

Why Should You Consider Using Know Your Dosh?

1. Beginner-Friendly

If you’re new to managing your finances, Know Your Dosh is a great place to start. Its simple, easy-to-navigate interface makes it perfect for beginners who want to learn how to budget and save without feeling overwhelmed.

2. Personalised Budgeting

Everyone has different financial needs, and Know Your Dosh understands that. The app allows you to set customised budgets based on your specific income and expenses. You can track your spending in different categories and adjust your budget accordingly.

3. Comprehensive Financial Overview

With Know Your Dosh, you get a clear and comprehensive overview of your finances. The app tracks your income, expenses, and savings goals all in one place, making it easy to understand your financial health.

4. Goal-Oriented

Whether you’re saving for a new phone, a vacation, or an emergency fund, Know Your Dosh helps you stay focused on your goals. It gives you a clear path to achieving your financial objectives, with regular updates and reminders to keep you on track.

Frequently Asked Questions

-

Is Know Your Dosh free?

Yes, Know Your Dosh offers free access to its core features. However, some premium features are available for a small fee. -

Can I link my bank account to Know Your Dosh?

Yes, Know Your Dosh allows you to link your bank accounts for automatic transaction tracking. -

Is Know Your Dosh safe?

Yes, Know Your Dosh utilises encryption to safeguard your financial data and provides two-factor authentication for enhanced security. -

How do I set financial goals in Know Your Dosh?

Setting financial goals is simple. You enter your target amount and timeline, and Know Your Dosh will calculate the monthly savings amount you need to reach your goal. -

Can Know Your Dosh help with debt management?

Yes, Know Your Dosh can track your debt payments and help you manage your repayment schedule.

If you’re looking for a user-friendly, effective tool to manage your finances, Know Your Dosh could be the perfect solution. It offers essential features such as expense tracking, budgeting, and goal-setting, all presented in an intuitive and user-friendly interface. Whether you’re new to personal finance or simply looking for a better way to manage your money, Know Your Dosh can help you stay on top of your finances and reach your financial goals.

👍 Get Stunning Lifetime Access Now!