Business sale owner financing can be a game-changing option for entrepreneurs purchasing a business. Buying a business is an exciting opportunity, but the process can sometimes feel overwhelming, especially when financing is involved. Fortunately, business sale owner financing offers a smoother, more accessible way to secure the deal. This option allows buyers to work directly with the seller to secure the funding. This article will explain how business sale owner financing works and why it could be your right choice.

What Is Owner Financing?

Owner financing occurs when the business seller acts as the lender. Instead of going to a traditional bank or other financial institution for a loan, the buyer makes payments directly to the seller over time. This is often done through a promissory note, outlining the loan terms, including interest rates and payment schedules.

For many buyers, owner financing offers a more flexible option than conventional bank financing. On the other hand, sellers can attract more potential buyers by offering owner financing. It’s a win-win situation for both parties.

How Does Business for Sale Owner Financing Work?

In owner financing, the buyer and seller agree on a price for the business. Afterward, the buyer makes regular payments to the seller over an agreed-upon period, much like a traditional loan.

Here’s a quick breakdown of the process:

-

Negotiation: The Buyer and seller agree on the business price, interest rate, and payment terms.

-

Promissory Note: Both parties sign a document outlining the repayment schedule and conditions.

-

Payment: The buyer makes regular payments to the seller.

-

Transfer of Ownership: Ownership of the business is transferred once the buyer fulfills the payment terms.

It’s a straightforward process, but the buyer and seller must trust each other. Typically, the buyer may need to provide a down payment upfront.

Benefits of Business for Sale Owner Financing

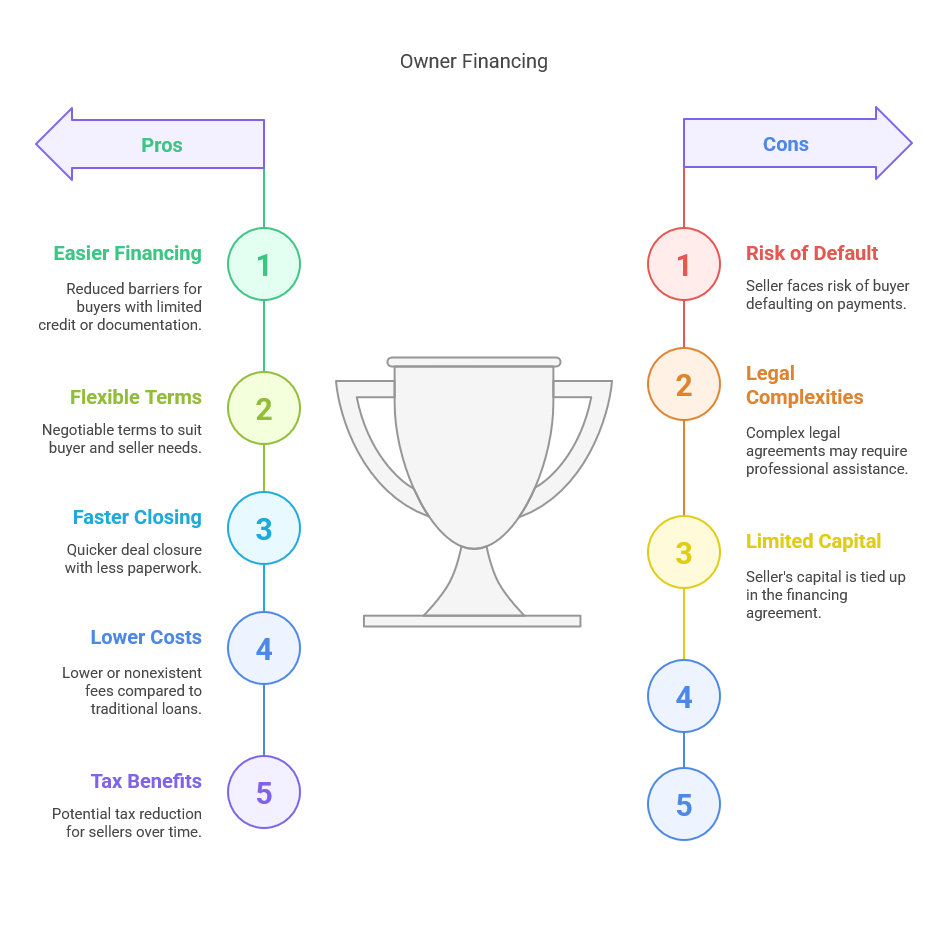

There are several advantages for both buyers and sellers when it comes to owner financing. Let’s explore some of them.

1. Easier Financing

One of the main benefits of owner financing is that it’s often easier to secure than a traditional loan. Banks and financial institutions can have strict requirements for loans. They may require significant documentation, a high credit score, and a lengthy approval process. With owner financing, these hurdles are reduced, making it more accessible for buyers with limited credit or other barriers.

2. Flexible Terms

Owner financing can offer more flexible terms than traditional loans. The buyer and seller can negotiate interest rates, payment schedules, and the overall loan amount to suit their needs. This flexibility can make it easier for the buyer to manage their finances and for the seller to secure a deal.

3. Faster Closing Process

The process of securing a traditional loan can take weeks or even months. With owner financing, the deal can close much faster. Since fewer parties are involved, there’s less paperwork, and the negotiations can happen quickly.

4. Lower Closing Costs

Traditional loans often come with significant fees, such as appraisal, origination, and closing costs. With owner financing, these fees are typically much lower or nonexistent. This makes the process more cost-effective for both parties.

5. Potential for Tax Benefits

For sellers, owner financing can offer potential tax benefits. By spreading out the sale of the business over time, sellers may be able to reduce their tax liability in the year of the sale. This can be a great option for minimising their tax burden.

Risks of Business for Sale Owner Financing

While owner financing has its advantages, there are some risks to consider. Both buyers and sellers must be aware of these risks before agreeing.

1. Seller Default

If the buyer stops making payments or defaults on the loan, the seller may have difficulty collecting the remaining payments. This can lead to financial losses or complications in the sale process.

2. Interest Rates and Terms

The buyer and seller must agree on reasonable interest rates and payment terms. If the terms are too harsh or the interest rate is too high, the deal could be unaffordable for the buyer, leading to default.

3. Legal Complexities

Owner financing can involve legal complexities, especially when the agreement is not documented correctly. Both parties must ensure that the terms are clearly outlined and that the promissory note is legally binding. It’s always a good idea to consult a lawyer before entering an owner financing agreement.

4. Limited Access to Capital for Sellers

While owner financing can be a great way to sell a business, it may not be ideal for all sellers. Those looking for immediate cash or who need a lump sum for retirement or other reasons may find owner financing less attractive. It’s important to consider whether this payment structure aligns with the seller’s needs.

Is Business-for-Sale Owner Financing Right for You?

Now that we’ve discussed the pros and cons of owner financing, you may wonder if it’s the right choice. The answer depends on your specific situation.

For buyers, owner financing can be an excellent option if:

- Securing conventional financing might be complex for you.

- Flexible repayment options could be necessary for your needs.

- Closing the deal quickly is a priority for you.

For sellers, owner financing can be a great choice if:

-

You want to attract more buyers.

-

You’re willing to take on some risk in exchange for a higher selling price.

-

You want to spread out the sale proceeds over time.

Key Considerations for Business Buyers

Before you commit to owner financing, it’s essential to take a few key considerations into account:

-

Due Diligence: Always perform thorough due diligence before buying a business. This includes reviewing financial records, understanding the business model, and evaluating the market.

-

Financial Stability: Ensure that the business has a solid financial foundation. This will help you make regular payments to the seller and ensure a smooth transition.

-

Consult Professionals: Consider consulting with a lawyer or accountant to ensure that the financing agreement terms are fair and that the business is a good investment.

Key Considerations for Business Sellers

If you’re selling a business and considering owner financing, here are a few things to keep in mind:

-

Know the Risks: Be prepared for the possibility that the buyer may default on the loan. Consider how you will handle this situation if it arises.

-

Set Clear Terms: Ensure that the financing terms are clear and that both parties understand their obligations. This will help prevent disputes down the line.

-

Get Legal Advice: Work with a lawyer to draft the promissory note and ensure the agreement is legally binding.

Frequently Asked Questions

1. What is the typical down payment for owner financing?

The down payment for owner financing varies depending on the terms of the agreement. However, a typical down payment is around 10-20% of the business price.

2. Can owner financing be used for any business?

Yes, most businesses can use owner financing if the buyer and seller agree on the terms.

3. Is owner financing available for small businesses?

Many small businesses offer owner financing, especially if the buyer has difficulty securing traditional funding.

4. What happens if I can’t make the payments?

If you can’t make the payments, the seller may be able to take legal action and repossess the business. Make sure you understand the consequences before agreeing to owner financing.

5. How do I calculate the interest rate for owner financing?

Interest rates for owner financing are typically negotiated between the buyer and seller. Depending on the risk, they may be based on current market rates or slightly higher.

Owner financing can be an excellent option for buyers and sellers looking to transact business. It offers flexibility, lower closing costs, and faster closing times. However, both parties should be aware of the risks involved and ensure that the terms are clearly defined.

If you’re considering buying or selling a business with owner financing, consult with professionals to ensure a smooth and successful transaction.